In the heart of Queens, a small credit union with deep roots in the Italian-American community is quietly celebrating a major milestone. This year, the Italian-American Federal Credit Union turns 90 — making it one of the oldest institutions of its kind still operating in the United States.

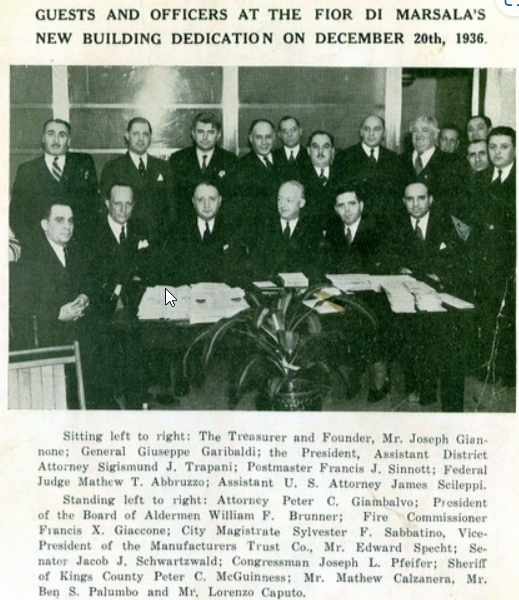

Founded in 1935 by immigrants from Marsala, Sicily, the credit union began as a way to provide loans to working-class Italian Americans who were often shut out of the mainstream American banking system. Nearly a century later, it remains a community anchor — still modest in size, but rich in history and connection.

While most Americans now turn to sprawling financial institutions with dozens of branches and call centers, the Italo-American Federal Credit Union runs on a different model: just one location, four employees, and a sharply personal approach to customer service.

“There’s no 1-800 number,” said Assistant Manager Francesco D’Amico, who also oversees the credit union’s IT systems. “When members call, they’re talking directly to us. We know their names, we know their stories. We even have young people who stop in just to talk and check their balances — something you don’t see with the big banks.”

With more than 700 current members — each of whom must join the Marsala Association to open a share account, the credit union’s version of a savings account — the institution has remained loyal to its roots. It all started as the Fior di Marsala Credit Union, created by Sicilian immigrants who pooled resources to serve a growing community.

“Back then, it was nearly impossible for Italians to get even small loans,” D’Amico said. “But this credit union quickly drew thousands of members. In the 1970s, the numbers began to decline as many families moved out of state. By the 1990s, we were down to just a few hundred.”

One key figure behind the credit union’s revival was Tony Di Piazza, who served as chairman from 2008 to 2012 and launched a sweeping campaign to modernize the institution and reconnect with the community.

“Credit unions often face skepticism,” D’Amico said. “But in reality, they’re among the safest places to save. We don’t gamble on stocks or risky ventures. We invest in corporate credit unions and federal securities. We’re audited and insured just like any other federal financial institution.”

Unlike commercial banks, the credit union’s board receives no salary, and earnings are returned to members in the form of favorable loan terms and low fees.

When D’Amico arrived in the United States in 2009, he had never heard of a bank that required Italian heritage to join. “I fell in love with the idea right away,” he said.

Starting as a teller, he helped lead the institution’s digital transformation — culminating in 2020 with the launch of online banking services, including transfers, account monitoring and competitive mortgages.

Today, he says, the credit union’s lending options rival those of major banks, with lower interest rates and faster approval times. “We don’t sell our mortgages to third parties, so everything stays under our roof. That means we can close faster and stay in control,” D’Amico said.

Looking ahead, the focus is on the next generation. The credit union recently began offering youth savings accounts to help families plan for college and teach younger members the value of financial responsibility — and cultural heritage.

“We want them to grow up with a sense of pride in this institution,” D’Amico said. “It’s not just a bank. It’s a symbol of where we came from, and what we’ve built together.”