Every week we hear of multi million dollar properties going on the market and sometimes the asking price seems exorbitant, and it really is! With this report we will take a closer look at the numbers of the Manhattan Luxury Real Estate Market, giving you the opportunity to get an idea of what the actual selling price of these luxurious properties is.

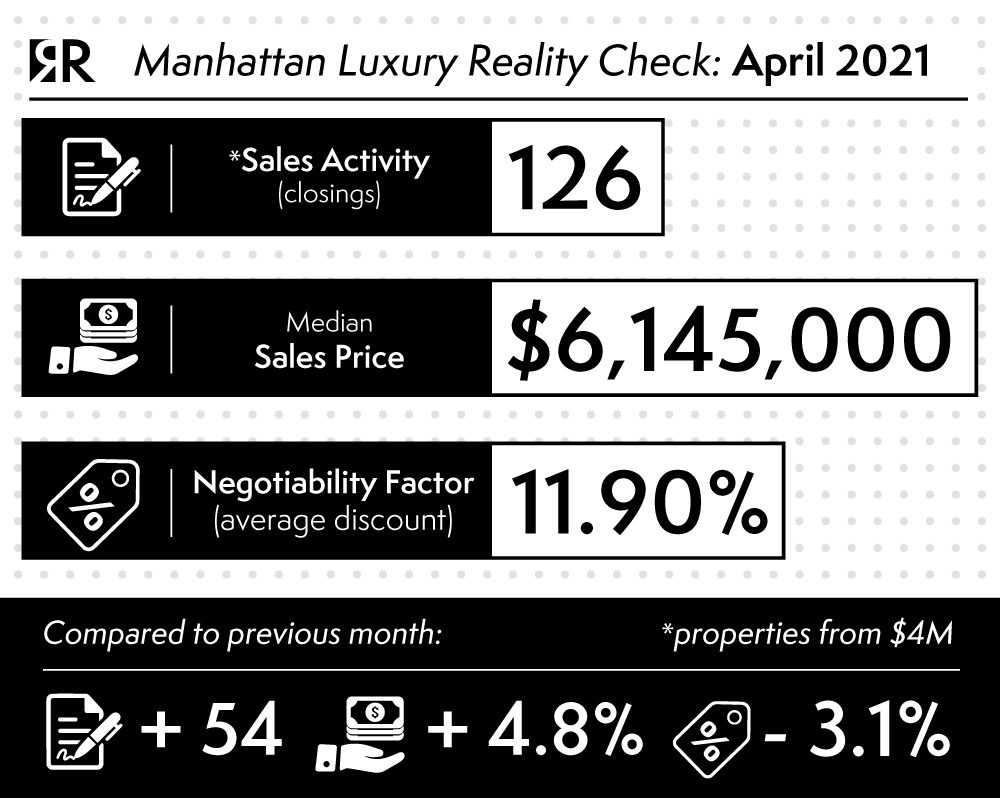

First of all, when we talk about Luxury Real Estate we are referring to properties closing at $4 million and above, and in Manhattan in April 2021 there were 126 of them, 54 more than in March.

Even though the Luxury Market generally doesn’t suffer the crises as badly as the rest of the market, during the harshest months of the Covid-19 pandemic this sector too had experienced a slowdown, and the fact that the number of sales is increasing bodes well for the next future. Both the Average Sale Price, + 16.7% equal to $8,292,123, and the Median Sales Price, + 4.8% equal to $6,145,000, have increased compared to March 2021. These rising values reflect the recovery status of the sector.

Even though the Luxury Market generally doesn’t suffer the crises as badly as the rest of the market, during the harshest months of the Covid-19 pandemic this sector too had experienced a slowdown, and the fact that the number of sales is increasing bodes well for the next future. Both the Average Sale Price, + 16.7% equal to $8,292,123, and the Median Sales Price, + 4.8% equal to $6,145,000, have increased compared to March 2021. These rising values reflect the recovery status of the sector.

However, not all indicators of a recovering market necessarily have the + sign in front of them, as a matter of fact the Negotiability Factor, the difference between the last asking price and the actual selling price, was 11.91%, down from the previous month when the data was 15.04%, which means a lower space for negotiations. The Days On Market, i.e. the number of days a property needs to be sold from the day of publication of the listing, is also decreasing, in April 2021 averaged 203, down from the 219 required in March 2021. A difference that, albeit slight, is synonymous with an increase in the pace of the market.

These numbers refer to a very specific sector of the Real Estate Market, less prone to drastic changes but at the same time in line with the general trend of the market, which in the case of New York City and Manhattan in particular, is experiencing a moment of strong rising of negotiations dictated by the exit from the Covid-19 pandemic.

South Florida: Powerful new rush of buyers sends housing prices soaring.

So far in 2021, residential real estate experts are reporting a powerful new wave of buyers, increasing the demand on an already low housing inventory throughout Miami-Dade County.

The powerful new wave of domestic buyers, purchasing more expensive primary residences and second homes with longer stays, is a direct result of the pandemic catapulting the remote working trend, tax reform creating tax refugees, Florida’s no state income tax, the influx of technology and finance companies, and “the awesome quality of life here and the enhanced buying power because of low-interest rates,” said Ralph De Martino, broker and president of Ocean International Realty and Master Brokers Forum’s board member.

Comparing January through April of this year to 2020, the statistics show that huge amounts of money are pouring into Miami real estate.

Looking specifically at the Miami Beach condominium market, in 2020 there were 504 closed sales at a median price of $349,700. Fast forward to 2021, there were 1,122 sales with a median price of $525,000, Mr. De Martino said. “That’s a median price increase of 50% – keep in mind that median is the price in the middle, with half of the sales sold for less and half for more. It is not the amount any particular property appreciated, and the number of sales increased by 123%.”

“The average price is less of an indication of price movement, but it reflects the fact that more expensive properties are selling,” he added.

The condominium 2020 average sale price was $695,693 compared to 2021’s $1,351,555, which is 94% higher and 332% more money being spent, Mr. De Martino said.

“My prediction is that looking forward, because of the consensus that this new wave of interest will continue, the market will continue to see substantial upward pricing pressure but not at a sustained rate of this year’s numbers.”

(source: miamitodaynews.com)