In a move to tackle the ongoing global debt crisis, a policy brief released by the UN Development Programme (UNDP) on Wednesday calls for an international restructuring of developing economies’ debt, potentially rewarding USD 148 billion in savings. UNCTAD Secretary General Rebecca Grynspan remarked during the International Debt Management Conference in December that lower and middle-income countries were trapped in a “vicious cycle” [of debt], blocking them from achieving sustainability and economic development goals.

Additionally, UN Secretary General Antonio Guterres has called for concrete, “no-nonsense”, action from wealthy nations to fund the UN Sustainable Development Goals (SDGs). The Secretary General’s demands are clear, yet wealthy nations fall short of formulating a substantial plan to contribute to developing nation’s sustainable funding.

The UNDP drafted the brief in anticipation for Friday’s G20 Finance Ministers and Central Bank Governors Meeting in Bangalore, India. “The building blocks to transform the global financial system are already being discussed at the G20 – multilateral development bank reform, debt restructuring, and injections of liquidity – but with the fracture between developed and developing countries escalating rapidly, we need to move from words to action,” Achim Steiner, the UNDP Administrator, echoed Guterres’s statement on SDGs from December. He continued that “the countries most burdened by debt and lack of access to financing are also being battered by multiple other crises; they are among the most affected by the economic impact of COVID-19, poverty, and the accelerating climate emergency”.

Although the brief falls short of action, it is a promising step in the right direction to address discrepancies between wealthy and developing nations’ ability to contribute to SDGs. The brief delineates a concrete cause and effect of alleviating developing countries from their crippling financial burdens. Steiner concluded by underlying the urgency of action. “The time has come to address the deepening chasm between rich and poor countries, to change the multilateral landscape and to create a debt architecture that is fit for purpose in our complex, interconnected, and post-COVID world.”

Wealthy nations play a crucial role in salvaging the “deepening chasm” as they are responsible for restructuring the debt developing nations acquire by borrowing from them. This would free up billions in funds to be reinvested in infrastructure, services, and sustainability. “The billions of savings identified by UNDP can only happen if we collectively agree that it is time to de-risk development and climate financing.” George Graw Molina, UNDP Chief Economist reiterated.

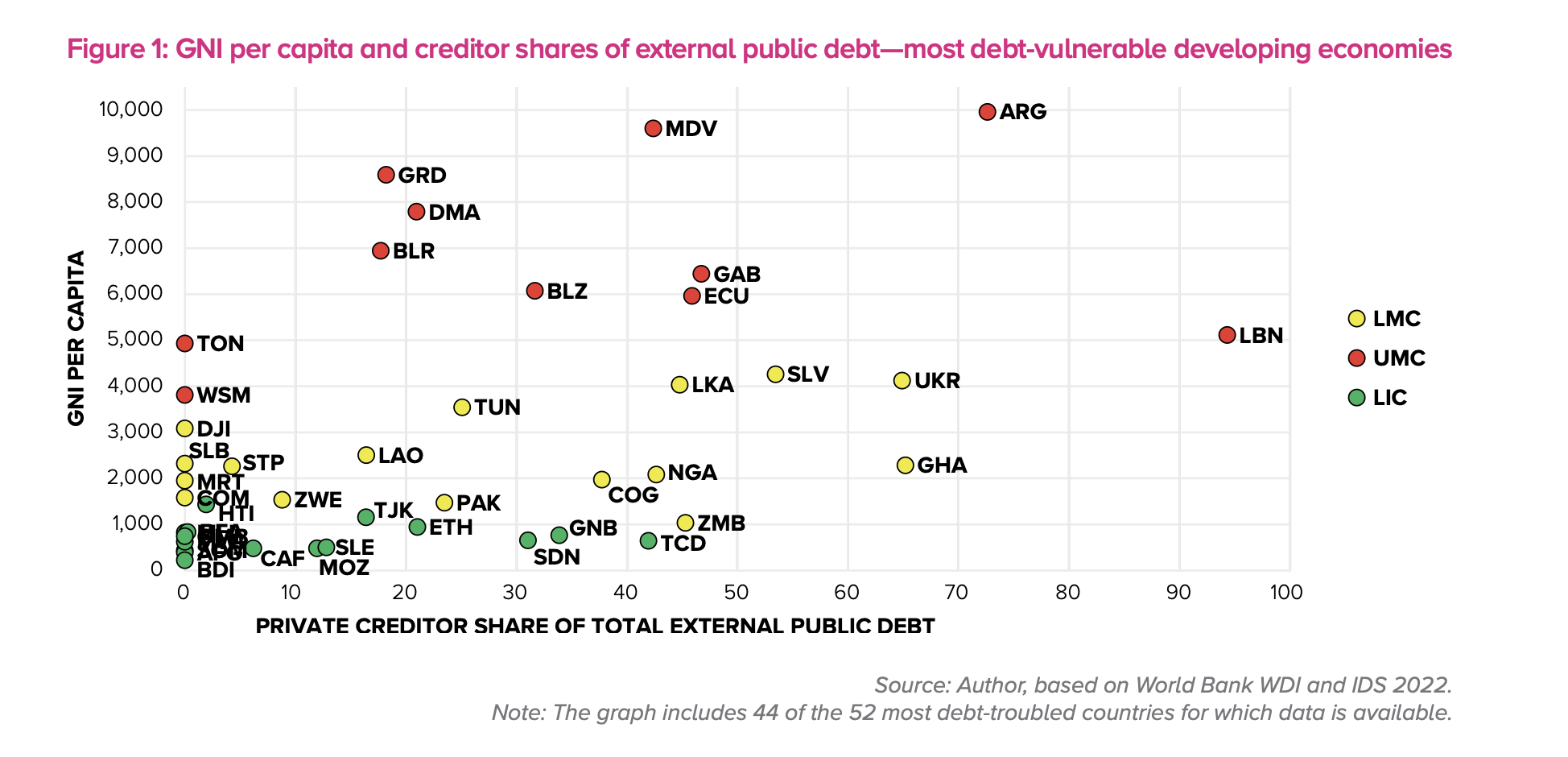

UNDP identified 52 low and middle-income economies that are either in, or in high risk of, debt destress which collectively account for over 40% of the world’s poorest population. Wealthy nations must unite to soften the financial blow for these nations if they are to invest in sustainable infrastructure and technology. The 17 SDGs are not only a blueprint for a “greener” future, but they are also crucial factors for economic development and vitality. In order to reach the SDGs, it is in every nation’s best interest to collaborate on building towards a future together.