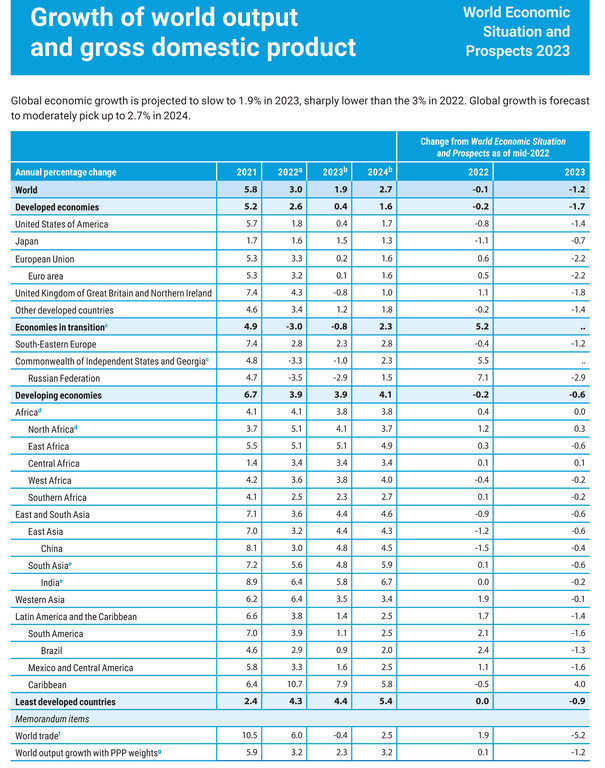

The resounding message from the UN World Economic Situation and Prospects 2023 cast a bleak warning of a continuing economic slowdown resulting in further deterioration of developing regions’ economies. With global output in 2023 predicted to fall to 1.9 per cent, down from 3 per cent in 2022, the report is particularly alarming for the world’s poorest nations. Although a far cry from optimistic, the report’s silver lining, corroborated by similar recent reports, shows the downturn may not be as drastic or as long-lasting as feared initially. “Several countries will see a mild recession before growth is forecast to pick up in the second half of this year and into 2024”, stated Ingo Pitterle, Senior Economist at the UN Department of Economic and Social Affairs (UNDESA).

According to the Citi Group, a New York-based investment bank, “the probability of a full-blown global recession, in which growth in many countries turns down in tandem, is now roughly 30%, [in contrast with] the 50% assessment that we maintained through the second half of last year.”

Although the outlook may not spell a dire situation for developed economies, the global downturn will place greater strain on developing nations. The pandemic-era economy resulted in some big winners and a tight labor market in wealthy nations while many developing economies were slow to recover, facing higher levels of unemployment. This most deeply reflects disproportionate loses in women’s employment during the pandemic. The slower recovery of labor supplied coupled with mounting debt vulnerabilities and heightened inflation puts many developing nations’ sustainable development initiatives at risk.

Global inflation, which reached a multi-decade high of about 9 per cent in 2022, is projected to ease but remain elevated at 6.5 per cent in 2023. Inflation arose in many economies rebounding from the pandemic as they experienced sharp rises in consumer prices while simultaneously facing food, energy, and supply chain shortages. These inflationary effects were hedged by central banks raising interest rates. According to the report, since 2021, over 85 per cent of central banks worldwide have tightened monetary policy and raised interest rates in efforts to calm inflation and avoid a recession.

The latest #WorldEconomyReport by UN DESA predicts global growth to slow sharply to 1.9% in 2023, from 3% in 2022.

Slow growth, high inflation and mounting debt burdens are threatening hard-won gains in achieving the #GlobalGoals.

Learn more at https://t.co/bILU4w7Gbi pic.twitter.com/kEmDbk1gyb

— UN DESA (@UNDESA) January 25, 2023

While many economies, particularly in the G7, are expected to rebound and recover by Q4 in 2023, developing and middle-income economies face longer-term challenges. Inflation in 2022 has deepened economic wounds in countries like Argentina which registered an annual (hyper)inflation of 94.8 per cent–exacerbated by the appreciating US dollar. The UN stated, “The region’s largest economies (Argentina, Brazil and Mexico) are expected to grow at very low rates due to tightening financial conditions, weakening exports, and domestic vulnerabilities.” Earlier this week, Brazil’s president, Luiz Inácio Lula da Silva, visited Argentina and announced a plan to create a common trade currency between the nations to reduce dependency on, and feared official adoption of, the US dollar.

This year’s report also suggested that China’s output would grow by 4.8 per cent, which is .5 per cent above the outlook provided by the World Bank. Although China’s output remains strong, its population has decreased for the first time in six decades and the nation has been slow to recover from its zero-covid restrictions, clouding economic forecasting from its once-promised position as the world’s largest economy.

The UN’s projected growth of 4.4 per cent for the world’s least developed countries remains far below the target of 7 per cent by 2030. “The top 10% now earns on average over 42 times what the lowest percentiles” commented Shantanu Mukherjee, director of the economic analysis and policy division of the U.N. Department of Economic and Social Affairs.

Additionally, the 17 Sustainable Development Goals (SDGs) are threatened. “This is not the time for short-term thinking or knee-jerk fiscal austerity that exacerbates inequality, increases suffering and could put the SDGs farther out of reach. These unprecedented times demand unprecedented action,” said António Guterres, UN Secretary-General. Developing countries’ financial requirements to reach SDQ amount to several trillions of dollars per year.

“Africa remains a full 2.4 percentage points below its pre-pandemic trajectory in contrast with developed countries who have been able to fully rebound”. Sherwin Bryce-Pease of South African Broadcasting during a press conference posed in his question to the panel on how the poorest region in the world will grapple with imminent economic threats caused by the climate crisis’ severe impact on the region. The UNDESA reports that the number of people facing acute food insecurity has reached almost 350 million in 2022, more than double compared to 2019. Prolonged economic weakness and slower income growth could delay poverty eradication efforts and leave very little left over to invest in SDGs.

“The global community needs to step up joint efforts to avert human suffering and support an inclusive and sustainable future for all,” commented Li Junhua, United Nations Under-Secretary-General for UNDESA. The report calls for governments to avoid fiscal austerity as it would negatively impact growth and put vulnerable groups at risk while calling action to reallocate and reprioritize public spending through direct policy interventions to aid job growth and economic prosperity.

Investment in education, health, digital infrastructure, technology, and action to mitigate climate change are imperative to accelerating the poorest economies in the world. To achieve social returns, productivity growth, and economic, social, and environmental resilience, they must stay aligned with the SDGs while wealthy nations ought to be held accountable to facilitate their success. Ultimately, the vitality of the global economy depends on the state of the world, and it is the responsibility of all players to improve the status-quo.