Trump was frequently given a “haircut.” But it’s not the kind you’re thinking of, not to his infamous blond pompadour, but to the estimates that he provided to the banks of his assets.

On Wednesday, in the second week of Trump’s civil fraud trial, Nicholas Haigh, a former Deutsche banker, took the stand. During his testimony, Haigh went on to describe what bankers refer to as a “haircut”. In his own words, “A haircut is a way by which the bank reduces the stated value of the asset in order to form some kind of assessment of what it might be worth, should there be a default.”

Deutsche Bank was one of Donald Trump’s most generous and consistent lenders – they gave him $400m over the course of ten years – and Haigh was involved in the haircut process.

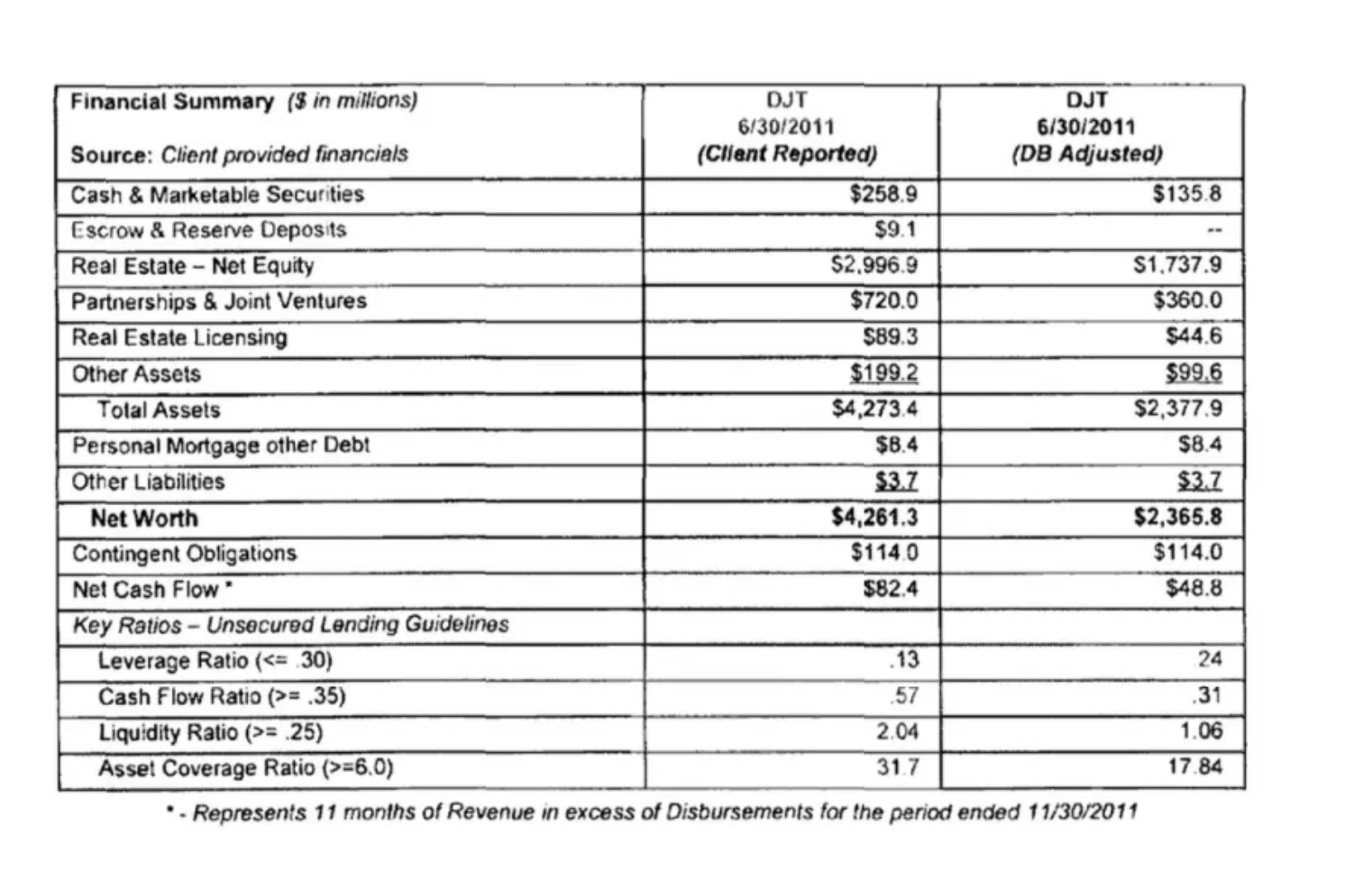

In his testimony, Haigh explains that the valuation cuts were specific to the property in question. Cash and marketable securities received minimal cuts because they are less likely to depreciate. Trump’s golf resorts, however, received cuts as high as 50%, and his Seven Springs estate in upstate New York was cut in value by 75% (it had initially included the value for nine luxury mansions that had yet to be built).

Evidence that was entered into the court showed that in 2011, Trump told the bank that he was worth $4.2 billion; Deutsche’s post-haircut valuation, however, was a more realistic $2.3 billion.

The haircut calculations are a key point in the trial; Trump says that he never defaulted on a loan, that he made Deutsche Bank millions off interest when he paid them and that Deutsche willingly lent him money even after severe valuation reductions. The prosecution instead argues that if those self-reported numbers were fraudulent, Deutsche would have likely never lent to Trump.

While he may be the one to command the headlines, Trump isn’t in this alone; he is joined as a defendant by his two sons, Don Jr. and Eric, as well as two former executives. They are accused of conspiring to lie about his net worth in the annual statements Trump used to secure the loans by Deutsche, claiming the former president inflated his valuation by as much as $3.6 billion a year.

The outcome of the trial will determine whether Trump will be permanently banned from running business operations in New York.

Just a day before Haigh’s testimony, Allen Weisselberg, Trump’s former CFO, claimed that Trump tripling the square footage of his penthouse in five years of financial statements was a minor miscalculation.

Trump shares his framing of the trial on TruthSocial, along with an image of a deal toy given to him by Deutsche:

This Trophy was given to me by Deutsche Bank because they were so proud of the Loan they made. They had the best Lawyers, the smartest Loan Officers, and were thrilled to do business with “TRUMP.” Interest was fully paid every month (no payment ever missed!), never received a default notice, and if Interest came due on a weekend, I paid it on a Friday. THE LOAN WAS PAID OFF FAR AHEAD OF SCHEDULE! Except for me, because of the Corrupt DOJ, FBI, and Racist New York State Attorney General, there were no Victims, there were only happy Bankers! But despite a PERFECT LOAN, I was sued by the Incompetent, Radical Left New York State AG, Letitia “Peekaboo” James, under a Statute that was never used for this before, and where I am not even entitled to a Jury. A Liberal Democrat Judge, with all Trump Haters surrounding him, is going to make this very important decision. If I had a Jury, I would win easily, but regardless, this is a case that should never have been brought. ELECTION INTERFERENCE!

The final outcome of the case is up to the presiding judge, Arthur Engoron. Trump might complain about the lack of a jury but the reality is his lawyers never requested one. His public lamentations are not meant to serve a legal purpose, however, he’s preemptively manufacturing the excuses he’s going to use when he loses, similar to his narrative surrounding mail-in-ballots in the leadup to the 2020 elections.